Advancing High Schoolers’ Financial Literacy

Forty-nine percent of US adults demonstrated financial literacy in a 2025 assessment.[1] Those who scored poorly were twice as likely to be debt-constrained, three times more likely to be financially fragile, five times more likely to lack or be unsure about sufficient nonretirement savings, and eight times more likely to spend 20 hours or more per week thinking about personal finance issues.

Financial literacy education is tied to later financial well-being. According to one study, graduation requirements in financial literacy classes, on average, are associated with students’ higher credit scores and reduced rates of credit delinquencies in adulthood.[2] Yet many students lack access to personal finance courses in high school. State leaders mulling financial literacy requirements for graduation can leverage teacher training and quality curriculum to close learning gaps, highlight instructional relevance, and support classroom engagement.

Graduation Requirements

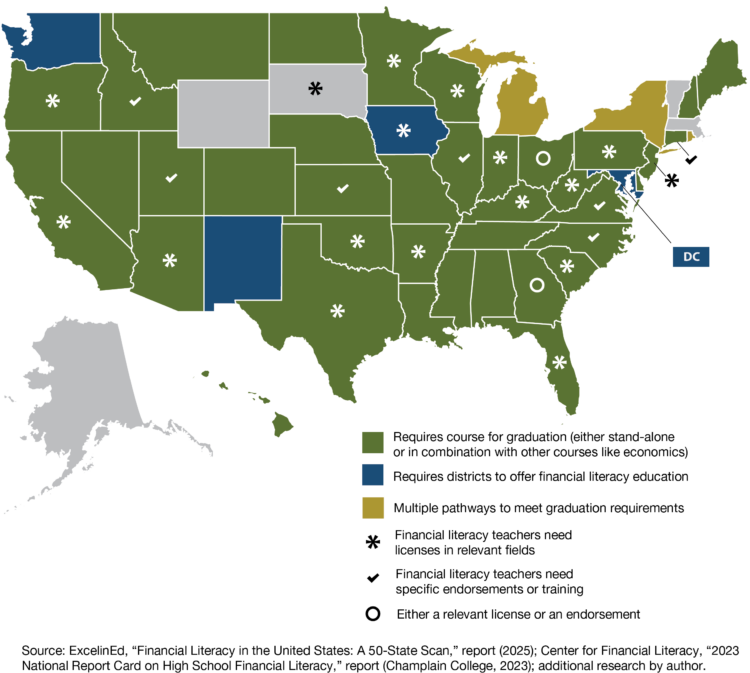

Most US adults say their state should require a semester- or year-long course focused on personal finance for high school graduation.[3] Forty-one states do require personal finance education for graduation (see map), three of which allow students to meet requirements through multiple pathways, which typically include a stand-alone course, a career and technical education program, an assessment, or the completion of an approved class project.[4] In 2025, Colorado, Delaware, Hawai‘i, Kentucky, New York, North Dakota, and Texas became the latest to adopt graduation requirements. In addition, five states require districts to offer financial education courses without requiring them for graduation.

Forty-one states require personal finance education for graduation

In Maine, districts must offer personal finance and economics as one of four learning strands for social studies. Similarly, in North Dakota, students may achieve their social studies requirements through courses like economics, which must incorporate financial literacy elements.

In states without graduation requirements, only one in ten students took a personal finance course before graduation, leading to pronounced gaps along racial, socioeconomic, and geographic lines.[5] Among these states, only 7 percent of students in schools with mostly Black and Hispanic student populations took a personal finance course before graduation—half the rate of schools with mostly non-Black and non-Hispanic populations.

Rhode Island allows flexibility in its graduation requirements. Districts can allow students to demonstrate proficiency in financial literacy by completing either a stand-alone course, an assessment, a school project, or another method proposed to and approved by the state board.

Maryland does not require a financial literacy course for graduation. However, in June 2010, the state board adopted regulations requiring local education agencies (LEAs) to provide a program of instruction in elementary, middle, and high school. The state education agency annually surveys LEAs on implementation, including a needs assessment and identification of resources, and provides updates to the state board. The latest update found that all 24 LEAs are implementing financial literacy in courses required for graduation, with 15 embedding it in required courses, and 9 adding specific graduation requirements for financial literacy.[6]

Standards

The National Standards for Personal Financial Education, which were adopted by Kansas, Rhode Island, Vermont, and Washington, organize instruction into six topics: earning income, spending, saving, investing, managing credit, and managing risk.[7]

The Georgia State Board of Education adopted new standards on personal finance and economics in December 2021, four months after they convened the Economics Review Committee to study and recommend amendments to its high school economics course. Initially, the committee considered creating a stand-alone course in personal finance, citing its relevance for all students. Hoping to avoid adding the number of required courses, the committee opted instead to revise the economics course to include comprehensive instruction in financial literacy.

State board member Matt Donaldson, who served on the committee, noted the value of engaging those who see firsthand what knowledge graduates lack, including classroom teachers and bankers. “A banker can tell you very easily if someone understands the fundamentals of credit or how to write a check or the difference between a debit and credit card,” said Donaldson, who is chief financial officer at a Georgia bank. “You need to start there to understand what kids are not understanding and then make sure they’re engaged.”

“You’ll constantly hear students say they wish they could learn things in school that have to do with them and what they need to know in the future,” said Ioannis Asikis, former student member on the Massachusetts Board of Elementary and Secondary Education. “When it comes to navigating your own finances, it’s missing. You’re thrown into adulthood without knowing the basics.”

Teacher Training

Rigorous teacher preparation is key to effective financial education. One study found that when students were taught by teachers who went through substantive training on personal finance education, their scores on assessments of their financial knowledge increased three times more than those taught by teachers without this training. The effects were even more pronounced for Black students and students from households with parents having only a high school degree.[8]

While no state requires a specific license to teach personal finance, eighteen require financial literacy teachers to hold licenses in relevant fields (such as business or economics); four require endorsements in financial literacy; two require either a relevant license or an endorsement; and Illinois, Kansas, and North Carolina require course teachers to have financial literacy training.[9] Rhode Island offers professional development in financial literacy but does not require it. In Delaware, districts must offer professional development and are encouraged to partner with external groups to support the course activities, including by serving as expert presenters, sponsoring competitions, awarding scholarships, or providing professional development.

Utah requires all financial literacy teachers to have an endorsement in general financial literacy and provides these courses, free of charge, twice a year. Tennessee offers teacher endorsements but does not require them.

Questions to Ask

According to the Champlain College Center for Financial Literacy, the four elements of a successful financial literacy educational program are requiring a stand-alone course for graduation, easy access to free curriculum and resources, well-trained educators, and funding.[10]

State boards can ask important questions to ensure students are graduating with relevant life skills:

- Who is going to teach the financial literacy courses? How will we ensure educators are fully equipped to implement financial literacy standards?

- What requirements or flexibilities are right for our state? Should students complete a single semester or a full year of coursework?

- What are the right curriculum and resources? What organizations can provide such materials?

- Who are the right stakeholders to study and make decisions on financial education? Whose perspectives are missing in our decision-making conversations?

“Financial literacy is applicable to everyone, whether you are going to college, whether you are going to technical school, or if you’re just going to work,” Donaldson said. “Everyone needs to understand money.”

“A lot of us are thinking about what our futures will look like, and being able to gain those skills in the classroom will make a tremendous difference,” Asikis said. “Yes, we are learning how to collaborate with people, work on teams, analyze texts, and stuff like that, [but] there’s so much more that we could be doing. Financial literacy is at the core of that.”

Joseph Hedger is program manager and editor at NASBE.

Notes

[1] Paul J. Yakoboski, Annamaria Lusardi, and Andrea Sticha, “Financial Literacy and Retirement Fluency in America: Findings from the 2025 TIAA Institute-GFLEC Personal Finance Index,” report (2025).

[2] Carly Urban, “The Effects of High School Personal Financial Education Policies on Financial Behavior,” Economics of Education Review 72 (2020).

[3] National Endowment for Financial Education, “Poll: Majority of U.S. Adults Continue to Want Financial Education in High Schools,” report (April 29, 2025).

[4] ExcelinEd, “Financial Literacy in the United States: A 50-State Scan,” report (2025); Center for Financial Literacy, “2023 National Report Card on High School Financial Literacy,” report (Champlain College, 2023); additional research done by author.

[5] Next Gen Personal Finance, “NGPF’s 2023 State of Financial Education Report” (March 2023).

[6] Maryland State Department of Education, “Personal Financial Literacy Education: 2024–2025 Financial Education Report” (November 2024).

[7] Council for Economic Education and Jump$tart Coalition, “National Standards for Personal Financial Education,” report (2021).

[8] The Financial Literacy Group, “Game Changer: The Evaluation of the Jump$tart Financial Foundations for Educators Professional Development Program,” report (April 2021).

[9] ExcelinEd, “Financial Literacy in the United States.”

[10] John Pelletier, “Is Your State Making the Grade? 2023 National Report Card on State Efforts to Improve Financial Literacy in High Schools,” report (Champlain College, Center for Financial Literacy, December 2023).

i

i

i

i

i

i